When a wise lender underwrites a credit request, they underwrite both the business and the project. Examples of projects are unlimited; but sample projects include leasing and outfitting a new business location or buying real estate where the business will operate.

Why does every dollar need a job?

Both the borrower and the lender must identify if there’s adequate capital to fund a project. Undercapitalizing a project is risky and often the root cause of project failures.

When working on an SBA loan, every dollar should have a mandatory job to perform. In fact, prior to submitting a loan to the SBA, a budget must be generated and supported with quotes and estimates. It’s imperative to understand that the SBA’s approval is not only for the loan-at-large; their approval is an authorization of specific ways the funds will be used for jobs to be done (e.g. to provide working capital, inventory, equipment, furniture, and so on).

How do you assign every dollar a job?

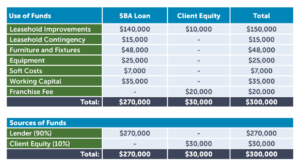

Thorough appraisal of a project’s budget begins when a loan applicant thoughtfully obtains relevant quotes and estimates. Lenders assist by calculating closing costs and ensuring their clients have adequate working capital built into their projects. Together, the lender and borrower create a sources and uses chart using estimates from reliable sources.

It’s easy to overlook this reality: The borrower’s money needs a job too. A client’s money should cover ineligible project costs, such as security deposits; but their capital can also supplement eligible project costs. Most importantly, the borrower’s money is required to enter the project before a lender follows suit.

What happens if the loan is approved for a certain amount but the project develops cost overruns?

A dollar can change jobs. For example, money allocated for leasehold improvements can move to purchase equipment, or vice versa, should one category come in under budget. The SBA is normally agreeable to these types of changes so long as there is a practical reason for the change. If actual spending exceeds the project budget, however, problems arise. For starters, most projects are not funded all at once; they’re funded incrementally as the project is completed. This means loan documents are generally executed by the time an overage occurs; and, as a result, increasing capital for a closed loan is difficult and sometimes even impossible.

Large project overages can also be viewed as a red flag, a poor reflection on a borrower’s ability to manage the financials of their business. Nonetheless, lenders know that overages happen. To proactively address this concern, lenders can build in an additional working capital component to cover minor unforeseen expenses. Specifically, lenders might build in a leasehold improvement contingency of 10%, the maximum amount allowable per the SBA.

Wise words

To prepare a sources and uses chart without making common and avoidable mistakes, we’ve collected advice from our team of 200+ SBA experts:

- Allocate adequate funds for taxes, delivery, and assembly costs. Don’t inadvertently overlook “hidden” charges (they can add up quickly!).

- Seek out bids from a number of vendors, not simply from low bidders who will fail to perform quality work in a timely manner. This is especially important when finding the right contractor.

- Prepare borrowers to understand: should the project go over budget, they’ll likely be obligated to cover the cost from their own pockets. Equipping clients with this knowledge from the beginning–when the sources and uses budget is first developed—protects all parties involved from future fall-out.

Sources and uses

The sources and uses chart below details how to provide every SBA project dollar a job:

Prudent Lenders can help

Unclear on whether a cost is eligible? Unsure how to structure a deal? Contact us today and learn how our team of SBA experts can help!